A 1031 exchange, otherwise known as a tax deferred exchange is a simple strategy and method for selling one property, that’s qualified, and then proceeding with an acquisition of another property (also qualified) within a specific time frame. The logistics and process of selling a property and then buying another property are practically identical to any standardized sale and buying situation, a “1031 exchange” is unique because the entire transaction is treated as an exchange and not just as a simple sale. It is this difference between “exchanging” and not simply buying and selling which, in the end, allows the taxpayer(s) to qualify for a deferred gain treatment. So to say it in simple terms, sales are taxable with the IRS and 1031 exchanges are not. US CODE: Title 26, §1031. Exchange of Property Held for Productive Use or Investment

A 1031 exchange, otherwise known as a tax deferred exchange is a simple strategy and method for selling one property, that’s qualified, and then proceeding with an acquisition of another property (also qualified) within a specific time frame. The logistics and process of selling a property and then buying another property are practically identical to any standardized sale and buying situation, a “1031 exchange” is unique because the entire transaction is treated as an exchange and not just as a simple sale. It is this difference between “exchanging” and not simply buying and selling which, in the end, allows the taxpayer(s) to qualify for a deferred gain treatment. So to say it in simple terms, sales are taxable with the IRS and 1031 exchanges are not. US CODE: Title 26, §1031. Exchange of Property Held for Productive Use or Investment

Due to the fact that exchanging, a property, represents an IRS-recognized approach to the deferral of capital gain taxes, it is very important for you to understand the components involved and the actual intent underlying such a tax deferred transaction. It is within the Section 1031 of the Internal Revenue Code that you can find the appropriate tax code necessary for a successful exchange. I would like to point out that it is within the Like-Kind Exchange Regulations, issued by the US Department of the Treasury, that you can find the specific interpretation of the IRS and the generally accepted standards of practice, rules and compliance for completing a successful qualifying transaction.

Why 1031 Exchange?

Any Real Estate property owner or investor of Real Estate, should consider an exchange when he/she expects to acquire a replacement “like kind” property subsequent to the sale of his existing investment property. Anything otherwise would necessitate the payment of a capital gain tax, which is currently 15%, but may go to 20% in future years. Also include the federal and state tax rates of your given state when doing a 1031 exchange. The main reason for a 1031 is that the IRS depreciates capital real estate investments at a 3% per year rate as long as you hold the investment, until it is fully depreciated (raw land can not be depreciated as it’s useful life is forever). When you sell the capital asset, the IRS wants to tax you on the depreciated portion as an income tax, and that would be at the marginal tax rate. Example, if you hold an investment for 15 years, the IRS depreciates it 45%. It then wants you to pay the taxes on that 45% depreciation. If combined state and federal taxes are 35% at the marginal rate, that’s about 15% of the cost of the property (one third of 45%). If your property is fully depreciated, it becomes the whole 35% marginal tax rate. Another way to make it easy to understand is when purchasing a replacement property (without the benefit of a 1031 exchange) your buying power is reduced to the point, that it only represents 70-80% of what it did previously (before the exchange and payment of taxes). Below is a look at the basic concept, which can apply to all 1031 exchanges. From the sale of a relinquished real estate property, we should understand this concept so that we can completely defer the realized capital gain taxes. The two major rules to follow are:

- The total purchase price of the replacement “like kind” property must be equal to, or greater than the total net sales price of the relinquished, real estate, property.

- All the equity received from the sale, of the relinquished real estate property, must be used to acquire the replacement, “like kind” property.

The extent that either of these rules (above) are violated will determine the tax liability accrued to the person executing the Exchange. In any case which the replacement property purchase price is less, there will be a tax responsibility incurred. To the extent that not all equity is moved from the relinquished to the replacement property, there will be tax. This is not to say that the (1031) exchange will not qualify for these reasons. Keep in mind, partial exchanges do in fact, qualify for a partial tax-deferral treatment. This simply means that the amount, of the difference (if any), will be taxed as a boot or “non-like-kind” real estate property.

THE 1031 Exchange Rule

A property transaction can only qualify for a deferred tax exchange if it follows the 1031 exchange rule laid down in the US tax code and the treasury regulations.

The foundation of 1031 exchange rule by the IRS is that the properties involved in the transaction must be “Like Kind” and Both properties must be held for a productive purpose in business or trade, as an investment.

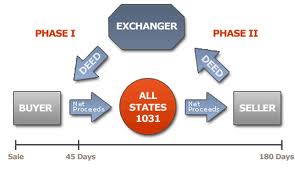

The 1031 exchange rule also lays down a guideline for the proceeds of the sale. The proceeds from the sale must go through the hands of a “qualified intermediary” (QI) and not through your hands or the hands of one of your agents or else all the proceeds will become taxable. The entire cash or monetary proceeds from the original sale has to be reinvested towards acquiring the new real estate property. Any cash proceeds retained from the sale are taxable.

The second fundamental rule is that the 1031 exchange requires that the replacement property must be subject to an equal or greater level of debt than the property sold or as a result the buyer will be forced to pay the tax on the amount of decrease. If not he/she will have to put in additional cash to offset the low debt amount on the newly acquired property.

1031 Exchange Rules and Timelines:

There are 2 timelines that anybody going for a 1031 property exchange or (NNN) should abide by and know.

The Identification Period: This is the crucial period during which the party selling a property must identify other replacement properties that he proposes or wishes to buy. It is not uncommon to select more than one property. This period is scheduled as exactly 45 days from the day of selling the relinquished property. This 45 days timeline must be followed under any and all circumstances and is not extendable in any way, even if the 45th day falls on a Saturday, Sunday or legal US holiday.

The Exchange Period: This is the period within which a person who has sold the relinquished property must receive the replacement property. It is referred to as the Exchange Period under 1031 exchange (IRS) rule. This period ends at exactly 180 days after the date on which the person transfers the property relinquished or the due date for the person’s tax return for that taxable year in which the transfer of the relinquished property has occurred, whichever situation is earlier. Now according to the 1031 exchange (IRS) rule, the 180 day timeline has to be adhered to under all circumstances and is not extendable in any situation, even if the 180th day falls on a Saturday, Sunday or legal (US) holiday.

Always consult your CPA and a 1031 exchange expert prior to diving head first into the 1031 world. As a seller, I love it when a buyer is doing a 1031 exchange as they lose negotiating leverage since they are under the gun to make a purchase during the exchange period. Remember don’t ever make a deal strictly to save money on taxes…